TL;DR: Americans now need to make $120K a year to afford a typical middle-class life and qualify to purchase a home. Minimum.

Where we failed is that $120k was supposed to be a middle-class income when living costs this much. The fact the median is 63k is a sign that all the excess value has been sucked out of the masses and funneled into the coffers of the billionaire class.

100% this. It’s not that costs rose as much as it’s that salaries didn’t increase.

In the late 70s around 23% of US corporate revenues went to pay salaries. By 2012 that had fallen to 7% - in other words, just before neoliberalism really took off almost 1/4 of the money workers spent buying goods from US companies was almost directly back in workers’ pockets, whilst by 2012 less that 1/14 of what workers spent buying goods from US companies ended back in workers’ pockets.

All that excess money that doesn’t get recycled back to workers anymore has got to be pooling somewhere.

It’s both. If the price of homes aren’t reflecting an affordable price, you have to ask, who’s buying them? It’s not the average family - it’s corps sucking up homes as investment assets, driving up prices to sell to each other and the “lucky” family or two that get to empty out their retirement fund just to have a place to live. That’s not reflective of a natural, reasonable increase. That’s the result of hedge funds destroying the housing market for the rest of us, just to pad their bank accounts.

That may be true in some of the lower priced Midwestern markets, but I sell real estate in Boston and I don’t see big corporate interests in the single family or owner occupied 2-3 family market. as much as big corporations have ruined a lot of things in this country, I don’t think we Dan just wave our hands and say “corporate buyers” and explain away our housing market problems.

We have a confluence of decades of exclusionary zoning and restrictions on building that make meaningfully adding to the supply of housing almost impossible. We have a huge deficit of qualified workers in the building trades, in part because all the work dried up after the great recession and people left the field and in part because we’ve pushed more and more kids to go to college. We have a mortgage system that’s nearly unique worldwide that allows homeowners tremendous advantages in keeping their housing costs low, but inversely provides tremendous disadvantages to having them move around more often and free up housing stock (so lots of aging singles and couples in big houses better suited for young people with kids). We have a society that’s bizarrely fixated on single family living even though we desperately need more density in most markets. And we have the problem of wage stagnation. None of those things are directly attributable to corporate ownership of large numbers of houses.

I’d love for there to be some silver bullet where we could just say “disincentivize corporations from owning small housing stock” and solve the problem, but it’s nowhere near that simple.

The link gives great context to the article. Thank you.

I honestly don’t even know why this upsets me so much. I am 50 and all set. I don’t have children and barely any debt. I never considered myself particularly patriotic but somehow this whole thing gets under my skin. I guess it sours my achievements and fruits of decades of struggle (it took three generations of planning and hustle to get us out of poverty). It’s like being a kid having a birthday party at Chuck E Cheese by yourself while all your friends are locked outside and you can see them through the glass windows.

It gets under my skin because the west was on the right trajectory; improving wealth equality, quality of life, work life balance, etc — Then Capitalists killed all those gains using Conservatism, Neoliberalism, and a bastardised version of Libertarianism — just to enrich a tiny percentage the human population and return the rest of humanity to feudalism.

Why should they own all the gains from humanities collective efforts, when all of us have a rightful claim to a share of those gains?

Because you have empathy for others, it’s a good thing.

I agree. Something I wish we saw more of.

Here’s what happened in a nutshell.

Lyndon Johnson had great plans for the US, but wanted to win the Vietnam War with one huge push. That quickly turned into a giant quagmire. LBJ and later Nixon, ordered bombing of the North. That meant the US factories were working 24/7. Nice for factory owners and union workers, but LBJ was paying for it with paper money because he didn’t want to raise taxes. Ironically, Nixon ran for President as an anti inflation and pro peace candidate.

Nixon and Kissinger doubled down on the bombing and inflation started to spiral. Also, those factories were getting a bit worn down. Unable to met the deamnd for the bombing and supply foreign markets the US ceded local steel making to Germany and Japan. This is going to bite the US in the ass when the Arab Oil boycott hits. US steel is much more oil dependant than the newer factories, so suddenly Toyotas and VWs are the hot cars, and US manufacturing takes a huge hit.

Carter tried to control inflation and cut oil use, but got kicked out over the Iran hostage mess. Reagan came in and cut taxes for the rich. This increased the debt, but gave the economy an unrealistic jolt.

tl dr. In 1960, minimum wage was $1.00/hour. The average house was $11,000.00 and $1 million was considered a vast fortune.* Middle class meant a High School graduate with a Union job supporting a family of four.

By the time Nixon, Reagan and Bush Sr were done, ‘middle class’ was two college degrees supporting the house and $1 million was what a rich guy paid for a party.

- In case anyone tells you that $1 million is 1960 would be $10 million today, tell them that in 1960, $100,000 would buy a mansion in Beverly Hills.

Poor tax laws on the richest 1% killed the American Dream.

Capitalism did that too. Capitalism is in a constant state of decline with short upward bursts of innovation that too will decline. Enshittification infects all.

Smith explained how, just a few years ago, $60-$70K a year would have been sufficient to qualify for a home.

Yeah, no. It was more than a few years ago.

I think that this has been trouble since 2007. Financial institutions went from giving lots of home loans to only giving corporations and the elite loans.

I don’t have a full Orlando market research report but pre-pandemic (2018) you could get a house in my neighborhood (Davenport) for $265k-325k. In 2024 the starting price is ~$650k. In 2018 I bought a house (Orlando) for my aunt to live in for $150k. After buying the little bungalow, I saw the rest of that neighbohood get gobbled up by investment funds and now it is almost completely rentals. The current comps have it at $325k.

Homes were dirt cheap from 2009 until about 2013, but everyone was broke. Prices were reasonable from 2014 to maybe 2018 (maybe). The post lockdown boom and investment fund buying spree has been insane.

But then you would have to live in Davenport. I’ve never seen a more literal suburban hell. 30 minutes of side streets to go anywhere without traffic.

You are not wrong.

I bought a house while making $40k/yr.

In Detroit?

If you want the results of the American dream the only way to do so is crime. Probably always been true, but boy is it truer than ever now.

inflation has hit ALL industries

Yeah, back in my day. A simple theft only got you a few days in jail. With inflation, we’re looking months now for the same crime.

Shakes head

transportation costs, suppliers, loss prevention is not 100%, insurances, food, lower customer base due to inflation/ cheaper lower quality alternatives (goes hand in hand), office supplies/ services, etcetera

inflation has hit everyone even in the shady areas

With the average cost of a house

Every fucking time with this shit.

The average price isn’t the price of a starter home, why do people fall for this clickbait.

That’s like trying to use the average price if a car as your starting point for how much you need to make to buy your first car.

Which means about the halfway point between a 1k beater and a fucking 200k rolls royces is what you are pretending a starter car is.

“Oh man the average price if a car is like 80k no one can afford to buy a car”

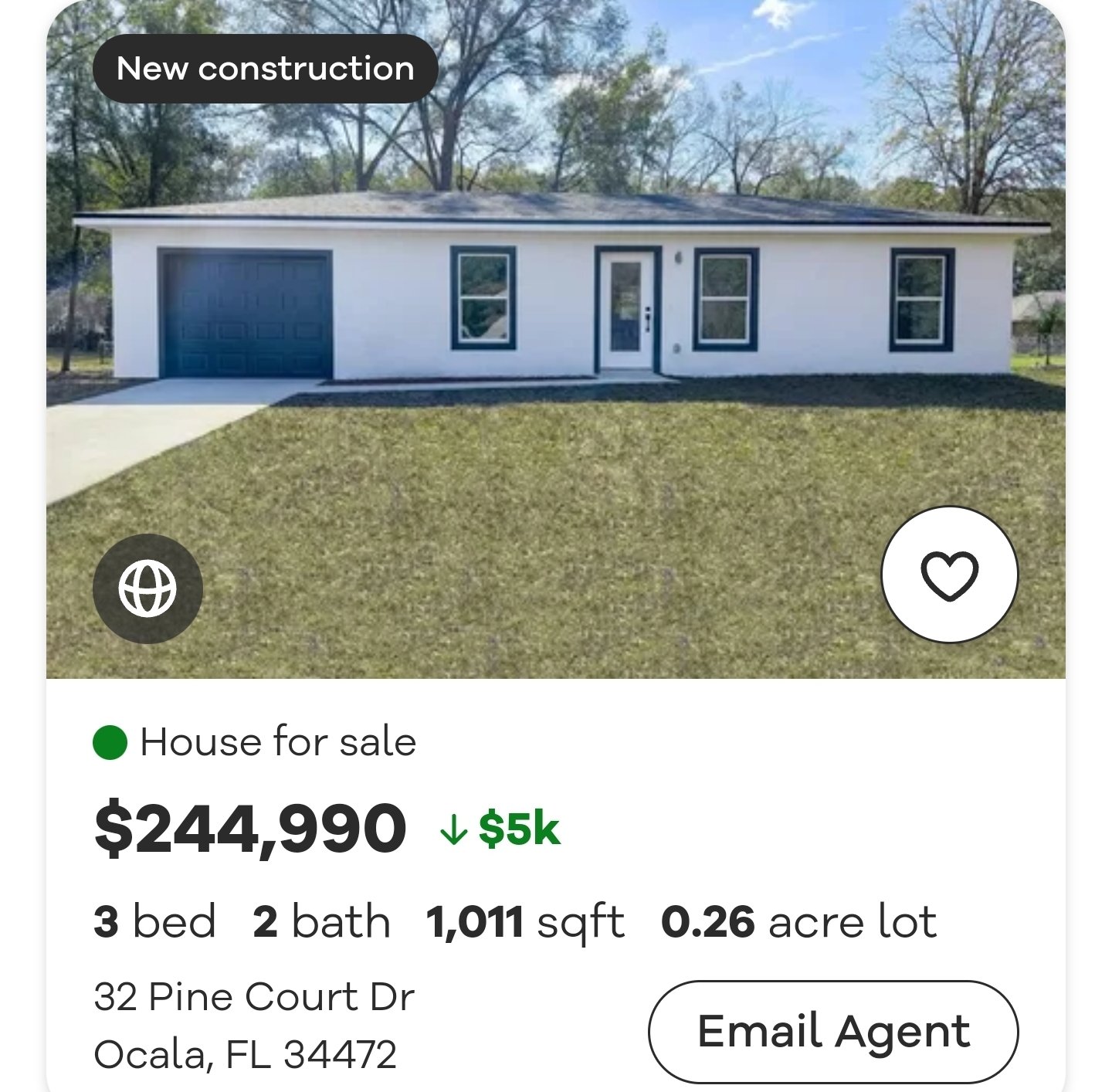

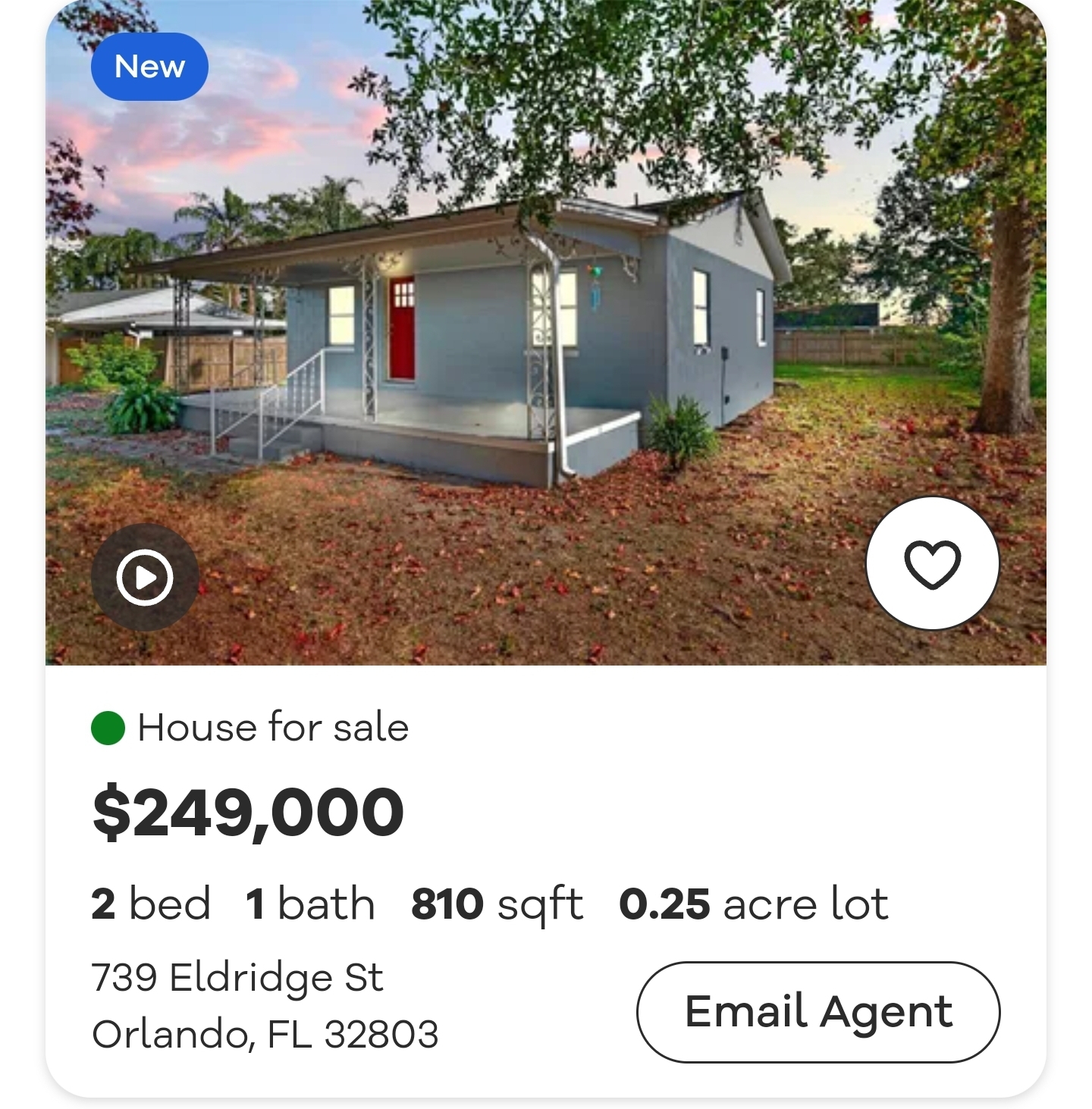

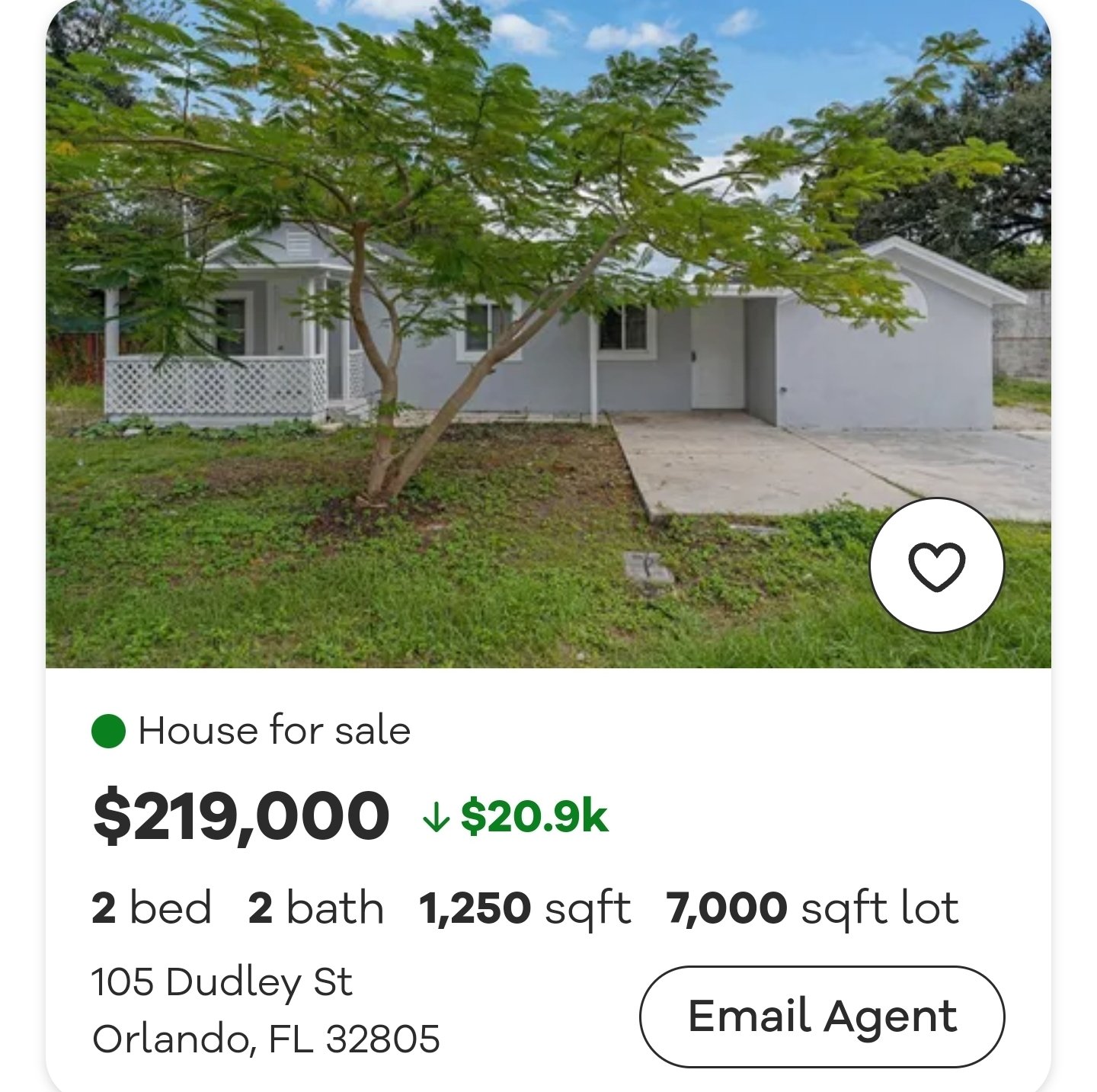

People are so stupid about this. You can get homes for like 200k to 250k in most major cities, that aren’t prime locations but 100% liveable and not a total dump, just need some work. That’s not even bottom of the barrel, you can go way cheaper if you want a total dump.

Everytime you see click bait like this, step one is Ctrl+F for the word “average” and you’ll find it everytime.

I shared this article because I have first hand knowledge of the Orlando market. Can you find homes in the 200-250k range? Yes. Should you live there? I wouldn’t recommend it. The minimum for a starter home in a relatively safe neighborhood is about ~300k and it probably needs work. Also, if you read the article, home prices aren’t the only pressure pushing the salary requirements up. That said, you have the right to believe what you want but as someone who recently purchased a home in the area, I think the author was fairly dead on.

He’s catching downvotes like crazy, but he’s 100% correct that average is a poor statistic for comparing things like home price and salaries. More specifically, average is typically used as a shorthand for “mean”, when what’s really useful is the median.

Median home price (or median salary) for that matter, will much more closely reflect what the typical person is paying for a house, while mean is going to be skewed by the long tail of expensive prices.

And also to back up Pixxelkick, that single number still doesn’t accurately reflect the situation for first-time home buyers, which is the demographic these articles tend to focus on when bemoaning high home prices.

So it’s not like anyone’s saying home prices aren’t going up, and there aren’t problems with that, but it does get really annoying to see these articles CONSTANTLY peppered with misleading or irrelevant statistics by authors who either don’t know what they mean, or worse are exaggerating to drive clicks.

I think he is catching flack for dismissing the article and making statements without a split second worth of research just because he doesn’t like the use of the word “average”. Below are all the “homes” in Orlando for $200k or less. Going up to $250k doesn’t make it much better.

Way to try and skew the results, took me 5s to find these on page 1 by just clicking to filter off foreclosures.

SMH, all these look just fine to live in, they are a bit old but the inside pics look quite well maintained and cozy.

I am not skewing the results. You have just decided that you are right even though you don’t have enough information to back up your claims. Remember when I typed this?

Can you find homes in the 200-250k range? Yes. Should you live there? I wouldn’t recommend it.

Of the four houses you listed, I recognize three of the street names and the third is in Ocala. Unless things have drastically changed since 2019, and they might have, you might want to be extra vigilant about your safety. Investment funds have been buying and flipping houses in some of the most crime riddled neighborhoods. So basically, you are spending $250k and betting that they neighborhood will turn around. It might, but it might not.

For context, those houses were well under $100k in 2015. Let us use one of the homes you listed (739 Eldridge St, Orlando, FL 32803) as an example. If you had just scrolled down you would have seen the valuation history.

It is OK to admit to be wrong and accept points of view from people that have more information and context than you. It is a great way to learn and expand your world view.

For context, those houses were well under $100k in 2015

That’s nearly ten years ago mate, lol

You are being purposefully daft and you’re just embarrassing at this point. Look at 2020, or just wrap yourself in your warm blanket of ignorance. It’s your life.

The 2 “houses” in the second image being listed for 200k are fucking insane.

Those two “houses” are almost $50k more than what I paid for a fully remodeled home for my aunt right before the pandemic. They are also in a significantly worse neighborhood.

Do you think starter homes didn’t go up? Talk about having your head in the sand. Open a real estate website, the average person can’t afford what they used too, it’s that simple.